Category: Deep Dive & Explained

-

WhiteBIT Exchange Review: Security, Features & Trading Fees Explained

Explore WhiteBIT Exchange: A secure, fast-growing crypto platform with strong security, fiat support, and competitive fees. Is it right for you? Find out!

-

Nexo Exchange Review: Is Nexo secure and worth your Crypto?

Is Nexo the best platform for earning on stablecoins & crypto? Read our in-depth Nexo Exchange review covering interest rates, loans & security.

-

How Specific Exchanges Compare for Stablecoin Liquidity

Stablecoin liquidity plays a huge role in crypto trading, lending, and DeFi, but different exchanges handle them in unique ways. Here’s a comparison of how major exchanges treat stablecoins: Binance (Tier 1 – Best for Stablecoin Liquidity & Pairs) Strengths: Weaknesses: Coinbase (Tier 1 – Best for USDC) Strengths: Weaknesses: Kraken (Tier 1 – Best…

-

How to Get Listed on Binance & Coinbase: Costs & Requirements (2025 Guide)

Discover the differences between Tier 1, Tier 2, and Tier 3 crypto exchanges, their listing costs, requirements, and how to get your token listed successfully.

-

The Truth About Stablecoin Stability: Collateral, Algorithms, and Market Forces Explained

Stablecoins maintain their value through collateralization, algorithmic adjustments, and market dynamics. Discover how these mechanisms ensure stability and their potential pitfalls.

-

The Ultimate Guide to Stablecoins: 4 Types You Need to Know About Today

Stablecoins serve as a vital bridge between cryptocurrency and traditional finance. This article delves into the four main types—fiat-collateralized, crypto-collateralized, algorithmic, and commodity-backed—highlighting their mechanisms and popular examples.

-

Introduction to Stablecoins: Definition, Importance and Benefits

Stablecoins are digital assets designed for price stability, serving as a bridge between volatile cryptocurrencies and traditional finance. They power trading, DeFi, and global transactions.

-

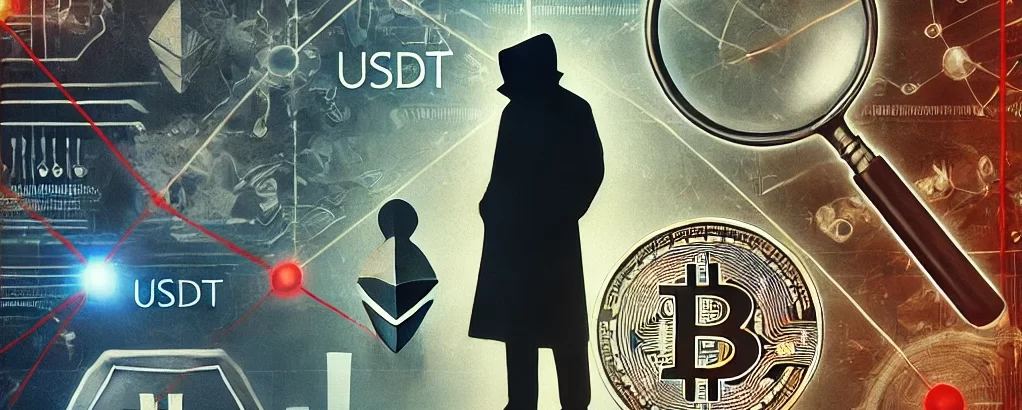

Stablecoin Speculation: Are USDT and USDC Manipulating Bitcoin Prices?

Uncover claims about USDT and Bitcoin price manipulation. Learn the facts, conspiracies, and how regulations like MiCA are shaping crypto transparency.

-

Bad Debt in Crypto Lending Explained: Risks, Examples, and How to Protect Yourself

Explore bad debt in crypto lending: causes, risks, and 4 real-world examples from Venus Finance, Aave, Compound, MakerDAO, and Cream Finance. Learn how to stay safe.

-

Secure Returns: Staking and Lending Stablecoins on SUI DeFi Protocols

The Sui Network is a revolutionary Layer 1 blockchain platform designed for fast, secure digital asset ownership. With its recent launch in May 2023, the ecosystem is still growing, and decentralized finance (DeFi) protocols are slowly emerging. This article covers the best DEXs and liquidity pools available on the Sui network, with insights into APYs,…